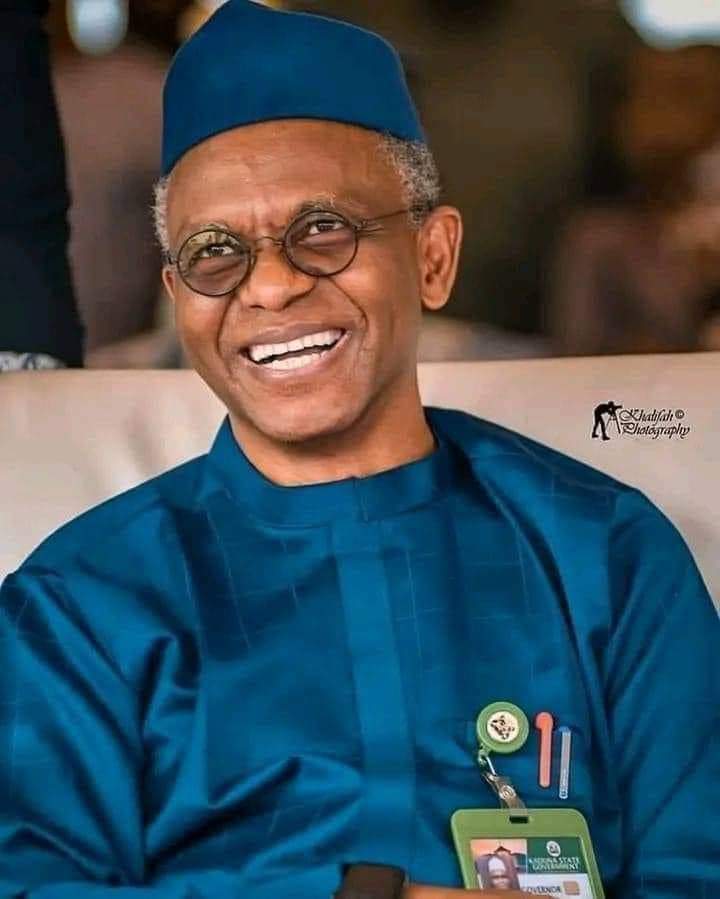

Although Nasir El-Rufai is no longer the governor of Kaduna State and has missed out on a controversial ministerial appointment, his enthusiasm for tackling significant initiatives remains unabated. The former governor is making a noteworthy entry into the private sector with a bold announcement.

El-Rufai is set to launch a $100 million venture capital fund dedicated to supporting startups in Nigeria, particularly those within the Kaduna tech ecosystem. Demonstrating his commitment, he plans to contribute $2 million of his personal funds to kickstart the fund and aims to secure additional funding from investors. These investors, according to El-Rufai, will be individuals who “believe in us but don’t have the capacity or the time to do the analysis and evaluation. But they trust our judgment, and they will come with us.”

In November, El-Rufai attended the Africa Investment Forum in Marrakech, where he discussed his plans with BusinessDay. Despite facing social media criticism in the past, the former governor appeared lively in Marrakech, actively participating in all sessions of the Africa Investment Forum. The forum serves as a multi-stakeholder platform with the goal of directing capital towards critical sectors to achieve the Sustainable Development Goals, the African Development Bank’s High 5s, and the African Union’s Agenda 2063. El-Rufai seems to have moved beyond his past disappointments and is determined to pursue new endeavors in the private sector.

He envisions establishing a venture capital fund or private equity that will invest in young Nigerians harboring innovative ideas, regardless of the sector, be it agriculture, ICT, or the creative industry. Nasir El-Rufai is determined to target ideas with the potential to bring value to the world.

Reflecting on his tenure as the governor of Kaduna, El-Rufai highlighted the abundance of students in Kaduna with remarkable ideas and innovations. However, he observed that many lacked mentorship and financial support to nurture their ideas.

According to El-Rufai, what these young individuals primarily need is mentoring and financing to propel their ideas forward and assess their viability. His proposed fund aims to act as a catalyst for them, providing not just financial support but also facilitating opportunities. El-Rufai emphasized the importance of leveraging their network, which includes access to ministers, presidents, and regulatory agencies, to guide these young innovators through the challenges they may face. In return for taking the risk and offering startup funding, the venture capital fund would seek an equity position in the business.

El-Rufai clarified that the goal is not to take over these businesses but rather to foster their development. By assuming a percentage of the business in exchange for the initial risk, the fund aims to support and grow these enterprises alongside the aspiring entrepreneurs.

Source: Business Day