- Venture capital (VC) is a form of private equity financing that is provided by venture capital firms or individual investors to early-stage and high-potential startups and small businesses.

Here are some key aspects of venture capital:

Stages of Investment:

- 1. Seed Stage: Funding provided at the very early stages of a startup’s development to help with product development, market research, and initial operations.

- 2. Early-Stage: This stage includes Series A and Series B rounds, where companies have usually developed a product or service and are looking to scale their operations and market presence.

3. Growth Stage: Companies at this stage have a proven business model and are focused on rapid expansion and market dominance. Series C and beyond are typical rounds at this stage.

4. Risk and Return: Venture capital investments are inherently risky because they involve startups with unproven business models and untested products or services. However, investors expect high returns if the startup succeeds, often aiming for several times their initial investment.

5. Exit Strategies: Venture capitalists typically exit their investments through various means, such as initial public offerings (IPOs), acquisitions by larger companies, or secondary market sales. These exit events allow them to realize the financial gains from their investments.

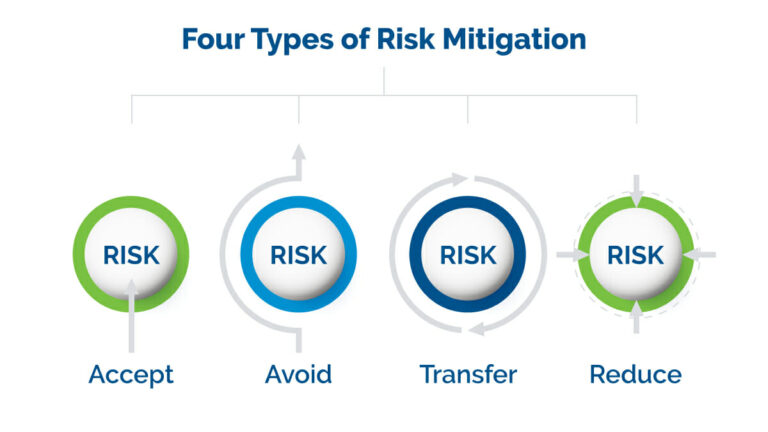

6. Risk Mitigation: Given the high-risk nature of venture capital investments, VC firms often diversify their portfolios by investing in multiple startups across different sectors and stages. This strategy helps spread risk.

The first step for any business looking for venture capital is to submit a business plan, either to a venture capital firm or to an angel investor. If interested in the proposal, the firm or the investor must then perform due diligence, which includes a thorough investigation of the company’s business model, products, management, and operating history, among other things.

Since venture capital tends to invest larger dollar amounts in fewer companies, this background research is very important. Many venture capital professionals have had prior investment experience, often as equity research analysts while others have a Master in Business Administration (MBA) degree. VC professionals also tend to concentrate on a particular industry. A venture capitalist that specializes in healthcare, for example, may have had prior experience as a healthcare industry analyst.

Leave a Reply